Webinar

Published December 16, 2024

Fraud Management

In this webinar, Experian industry experts dive into our latest research on the convergence of credit and fraud risk. Discover what's driving these trends and how forward-thinking organizations can enhance risk management and operational efficiency by breaking down silos.

Watch to learn:

- How new and emerging fraud threats are reshaping fraud risk and impacting portfolio management.

- Increasing operational efficiency and enhancing risk assessment with centralized credit and fraud strategies.

- Aligning fraud prevention with your organization’s risk tolerance.

Complete the form to watch the webinar

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Webinar

Webinar

Exposed: Identity Risk, the Dark Web and the Score that Changes the Game

Join Experian’s Dark Web Intelligence Team to explore how to score consumers’ identity health and the benefits for both businesses and consumers.

We'll break down:

- The accelerating risk of identity exposure on the dark web and what it means for your organization and your customers

- Case studies of fraud events detected through dark web alerts

- How Experian's Identity Health Score translates signal data into action, helping you identify at-risk consumers, upsell safely, inform cyber insurance strategies, and protect employees

Report

Report

The State of U.S. Rental Housing Market Report 2025

The 2025 U.S. rental market reflects broader economic conditions, shaped by shifting market forces and ongoing uncertainty. Landlords and property managers are navigating a complex landscape where understanding renter behavior, affordability challenges, and macroeconomic pressures is key to maintaining stable occupancy. By staying informed on these trends, they can better attract and retain long-term tenants.

Key Insights:

- Renter Financial Pressure: Renters across all demographics are facing rising debt and affordability issues, impacting their housing stability.

- Rent-to-Income Imbalance: Rent prices continue to rise faster than incomes, increasing the financial burden on tenants nationwide.

- Macroeconomic Impact: Factors like interest rates, unemployment, and housing development are reshaping rental market dynamics.

- Strategic Adaptation Needed: Landlords must adapt to evolving renter preferences and market conditions to ensure long-term success.

Webinar

Webinar

State of Card: Unmasking Fraud Disguised as Credit Risk

With the recent Fed announcement and fewer interest rate cuts on the horizon, it’s time to posture your organization more defensively. Where to start? A portfolio management activity that is often overlooked is the accuracy behind classifying fraud and credit risk.

Join our experts for an insightful webinar where they’ll review:

- The state of the Credit Card industry

- The value of performing lookback reviews – beyond accuracy

- Credit tools to help your portfolio management strategies

Video

Video

A Growing Small Business Financial Fraud Problem

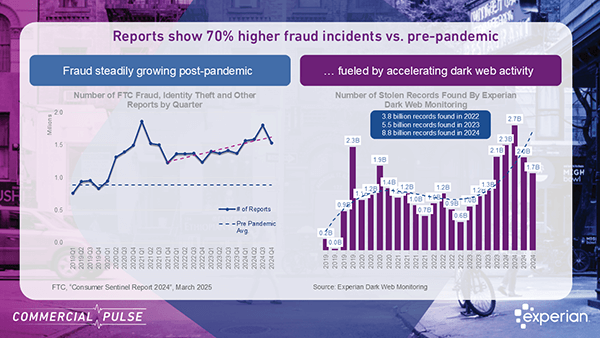

This week’s Commercial Pulse Report from Experian reveals critical shifts in the economy for small businesses. Inflation eased slightly to 2.8%, and the Small Business Index ticked up to 41.5—signs of stabilization. But rising financial fraud remains a major concern. Also:

🔒 70% increase in fraud since the pandemic

🧠 $40B in projected losses from AI-driven scams by 2027

📊 46% of SMB loan applications showed signs of first-party fraud

Lenders are responding with AI-powered analytics and cross-industry collaboration to stay ahead of these threats.

Check out the full report to see how these trends could impact your strategy!