Latest Posts

As small businesses prepare for growth - tariffs take center stage Experian is very pleased to announce the release of the Q3 2024 Main Street Report. Join us for a deep dive on Q3 performance Experian will share key findings from our Q3 Main Street Report in the Quarterly Business Credit Review: Tuesday, December 10th, 10:00 a.m. Pacific | 1:00 p.m. Eastern Register to attend Gain insight on small business health The Q3 2024 Experian Main Street Report offers a deep dive into the economic trends and policy shifts shaping small business performance and their credit outlook. With credit risk managers at the forefront of navigating evolving financial landscapes, the report highlights critical developments in economic stability, global trade, and credit performance. These insights are essential for refining risk assessment strategies and positioning portfolios for a resilient 2025. Download the latest report for more insight. Download Q3 Main Street Report

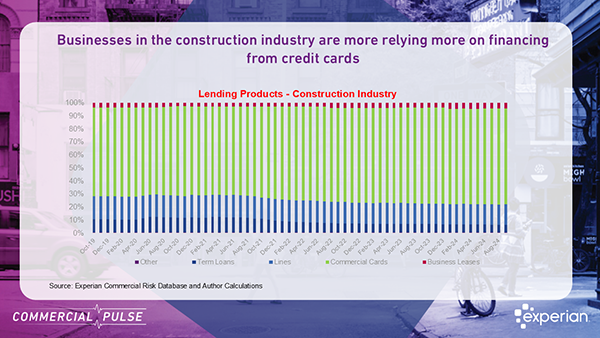

Discover key trends in housing and construction from Experian’s November 2024 report. Explore rising costs, resilient strategies, and future opportunities!

Join the experts from Experian for a review of quarterly small business credit performance along with a macroeconomic outlook.

Welcome to our November 12th, 2024 Commercial Pulse Report preview! Experian’s new Commercial Pulse Report highlights the economic trends shaping the retail landscape as we head into the holiday season. With 2.8% GDP growth in Q3 and steady unemployment at 4.1%, the economy shows resilience, yet retail businesses are navigating a mix of growth and caution in credit and spending trends. Watch Our Commercial Pulse Update This week as the holiday season gets under way, the team pulled together some interesting insights on the retail industry. With 2.8% GDP growth in Q3 and steady unemployment at 4.1%, the economy shows resilience, yet retail businesses are navigating a mix of growth and caution in credit and spending trends. Rising Credit Demand in Retail: Over the past year, commercial credit demand among retail businesses has surged by 25% as retailers boost inventory levels in anticipation of holiday sales. While demand is strong, businesses are finding that lending conditions are tighter than in previous years, especially in discretionary retail sectors. Lending Disparities Across Retail Sectors: Not all retailers benefit equally from this increased credit demand. Discretionary sectors like home goods are facing a drop in new commercial accounts and smaller loan sizes, reflecting a more cautious lending environment. Meanwhile, Consumer Electronics and Department Stores are seeing credit demand nearing pre-pandemic levels, indicating resilience in these areas. Higher Delinquency Rates Impacting Credit Scores: Rising financial pressures are pushing up delinquency rates, putting additional strain on commercial credit scores across the retail sector. This trend is a reminder for retailers to manage credit carefully, even as they position themselves for peak season sales. Slower Retail Sales Growth: Retail sales continue to grow but at a decelerating rate, with only 1.7% year-over-year growth from September 2023 to September 2024—a significant slowdown from previous years. Retailers are adjusting to a post-pandemic normalization as consumer demand steadies. With both opportunities and challenges ahead, this report offers insights to help retailers navigate the season. For more, check out Experian’s Commercial Insights Hub to see how these trends may impact your business. Download Commercial Pulse Report Commercial Insights Hub

Explore how fintech growth impacts credit managers: increased credit activity, higher loan balances, but with greater delinquency risks in business financing decisions.

Get the latest Commercial Insights from Experian's October 2024 report—covering inflation, job growth, and why 75% of small businesses remain underinsured.

The Fall Beyond The Trends report offers a unique view into the challenges hitting small businesses, and how to navigate a cooling economy.

In this week’s Commercial Pulse report, we take a closer look at the burgeoning population of Women-owned businesses.

Experian’s Sentinel™ Commercial Entity Fraud Suite received a silver medal for "Best Know Your Customer/Business (KYC/KYB) Innovation.